Understanding the Financial Impact of Cancer

As two-time lymphoma cancer survivors, we understand firsthand the financial burden that cancer can place on individuals and families. Cancer not only takes a toll on physical and emotional health but also on finances.

This article will explore the truth behind the relationship between cancer and finances.

Cancer is not just a health issue. It is also an economic issue. The cost of cancer treatment can be exorbitant, with many patients facing hidden expenses beyond medical bills.

Even those with insurance can face financial hardship due to high deductibles, co-pays, and out-of-network expenses. Cancer patients may sometimes be forced to choose between treatment and bankruptcy.

Navigating the complex world of insurance and cancer can also be a challenge. The connection between cancer and insurance is not always straightforward, and patients may face coverage denials or limited options. In this article, we will delve into the economic impact of cancer and explore coping strategies for cancer-related financial stress.

Key Takeaways

- Cancer can have a significant financial impact on individuals and families, with hidden costs beyond medical bills.

- Navigating the complex world of insurance and cancer can be challenging, with patients facing coverage denials or limited options.

- Coping strategies for cancer-related financial stress are essential, and non-profit organizations and government policies can play a role in supporting cancer patients and their families.

The Relationship Between Cancer and Finances

As a two-time lymphoma cancer survivor, we know firsthand the financial burden that cancer can bring. Cancer treatment can be incredibly expensive, and out-of-pocket costs can quickly add up even with insurance. A study found that having health insurance does not necessarily protect people with advanced cancer from financial hardship [1].

Cancer can have a significant impact on a person’s finances. According to the Cancer Council, it is estimated that 60% of people affected by cancer face distress from legal and financial challenges in addition to their health concerns [2]. Cancer-related financial hardship can affect the patient, family, and caregivers [3].

The financial burden of cancer can come from various sources, such as medical bills, transportation costs, and lost wages due to time off work. Additionally, some cancer treatments may not be covered by insurance, leaving patients to pay for these treatments out of pocket. This can lead to significant financial stress and even bankruptcy in some cases [4].

It is essential for cancer patients and their families to be aware of the potential financial impact of cancer and to plan accordingly. This may involve seeking financial counseling, exploring financial assistance programs, and discussing treatment options with healthcare providers to understand the costs.

Ultimately, the relationship between cancer and finances is complex and can be a significant source of stress for patients and their families. Awareness of cancer’s potential financial impact and seeking support and resources to help manage these challenges is crucial.

[1] https://www.cancer.gov/news-events/cancer-currents-blog/2022/financial-problems-advanced-cancer [2] https://www.cancer.org.au/assets/pdf/cancer-and-your-finances-booklet [3] https://pubmed.ncbi.nlm.nih.gov/21769990/ [4] https://www.cancer.gov/about-cancer/managing-care/track-care-costs/financial-toxicity-pdq

The Economic Impact of Cancer

Cancer not only has a significant impact on an individual’s physical and emotional health but also has a significant economic impact. According to the Agency for Healthcare Research and Quality (AHRQ), the direct medical costs of cancer in the US in 2015 were $80.2 billion. This includes cancer treatment, hospitalization, and other medical expenses.

In addition to the direct medical costs, cancer has indirect costs, such as lost productivity and income. According to the Cancer Atlas, the economic burden of cancer in the US is approximately 1.8% of the gross domestic product (GDP). This includes healthcare spending, productivity losses due to morbidity and premature death, and informal care costs.

Individuals living with cancer and their families also face significant financial burdens. The total annual economic cost of cancer is estimated at approximately US$1.16 trillion, according to World Cancer Day. Cancer patients often face high out-of-pocket costs, such as co-payments and deductibles, leading to financial distress and bankruptcy.

It is important to note that vulnerable groups, such as those with lower income and rural or remote locations, are more susceptible to economic vulnerability related to reduced utilization of cancer care and its impact on outcome, according to a study on the economic perspective of cancer care.

As a two-time lymphoma cancer survivor, we understand the financial burden that cancer can have on individuals and their families. Hell, I’m living proof. It is crucial to have access to affordable, cutting-edge cancer care and resources to help mitigate the economic impact of cancer.

The Hidden Costs of Cancer Treatment

When we were diagnosed with cancer, we knew it would be expensive. However, we did not fully comprehend the extent of the financial burden that we would face. Cancer treatment is not just about the cost of medical care and life-sustaining drugs. Many hidden costs can be financially devastating for cancer patients and their families.

One of the hidden costs of cancer treatment is the cost of transportation. Cancer treatment often requires frequent hospital or clinic visits, which can add up quickly. We had to pay for gas, parking, and sometimes even lodging when traveling long distances for treatment.

Another hidden cost of cancer treatment is the cost of food. Cancer treatment can cause nausea, vomiting, and other side effects that make eating difficult. We had to buy special foods and supplements to help us maintain our weight and keep our strength up, which added to the overall cost of treatment.

The cost of cancer treatment can also lead to financial toxicity, which is the economic burden that patients experience from the expenses related to getting treatment for their cancer. According to a 2020 estimate, the average cost of cancer treatment in the United States is around $150,000. This cost can be overwhelming, especially for those without health insurance or limited coverage.

The hidden costs of cancer treatment can be significant and add up quickly. It is vital for cancer patients and their families to be aware of these costs and to plan accordingly. Seeking financial assistance, talking to a financial counselor, and exploring other cost-saving options can help alleviate some of the financial burden.

Insurance and Cancer: A Complex Connection

Regarding cancer treatment, insurance coverage is crucial in determining a patient’s quality of care. Unfortunately, the relationship between insurance coverage and cancer care is unclear. According to a study published on PubMed, uninsured patients are less likely to receive optimal cancer care.

However, even those with insurance are not immune to financial hardship. A study by the National Cancer Institute found that “having health insurance doesn’t necessarily shield people with advanced cancer from financial hardship” (Cancer.gov). This is especially true for advanced cancer patients who require ongoing treatment and care.

In addition to the direct costs of cancer treatment, such as co-pays and deductibles, indirect costs can add up quickly. These may include transportation costs, lost wages due to time off work, and other related expenses.

Cancer patients and their families need to understand their insurance coverage and the potential financial implications of cancer treatment. Some insurance plans may cover specific treatments or medications, while others may not. It’s also important to consider the out-of-pocket costs associated with different insurance plans, such as deductibles and co-pays.

As a two-time lymphoma cancer survivor, we know firsthand the financial challenges of a cancer diagnosis. We understand the importance of having access to quality care and the impact that insurance coverage can have on a patient’s treatment options. I encourage all cancer patients and their families to explore their insurance options and seek resources and support to help navigate the complex financial landscape of cancer treatment.

Cancer and Bankruptcy: A Harsh Reality

Cancer patients battle the physical and emotional toll of their illness and the financial burden that comes with it. According to a study, cancer patients are 2.65 times more likely to file for bankruptcy than those without cancer, putting them at a higher risk for early death (NPR).

The Role of Medical Debt

Medical debt is still the top reason cited for bankruptcy in the United States, and cancer patients declare bankruptcy 2.5 times more often than healthy people (Project Purple). Even in cases where patients do not go bankrupt, they often face significant financial burdens due to their diagnosis. Cancer treatment is expensive, and even with health insurance, the out-of-pocket costs can be overwhelming.

Surviving Cancer, Battling Debt

Surviving cancer is a tremendous accomplishment, but it does not come without a cost. The financial burden of cancer can be overwhelming, and it is essential to have a plan to manage the expenses. One way to manage the costs is to work with a financial counselor, who can help develop a budget and explore options for financial assistance.

It is also essential to communicate with healthcare providers and insurance companies to ensure that bills are accurate and all available benefits are utilized.

Cancer and bankruptcy are a harsh reality that many patients face. However, with proper planning and support, it is possible to manage the financial burden of cancer and focus on the journey toward recovery.

The Role of Health and Life Insurance

As cancer survivors, we understand the importance of health and life insurance when managing the financial burden of cancer treatment. Having adequate health insurance coverage with no gaps is essential to ensure we can receive the necessary medical treatment without worrying about the cost.

Life insurance can also provide peace of mind, knowing that our loved ones will be cared for financially if the worst happens. Some life insurance policies may even offer benefits if we are diagnosed with a critical illness like cancer.

It’s important to note that having insurance does not necessarily guarantee protection from financial hardship. According to a study, even insured individuals with advanced cancer may still experience financial difficulties. Therefore, it is crucial to carefully review and understand the terms and coverage of our insurance policies.

We recommend speaking with a trusted insurance agent or financial advisor to explore our options and find the best insurance plan that fits our needs and budget. In addition, keeping a careful record of medical bills, insurance claims, and payments can help us manage our finances better and lower our stress levels.

Look health and life insurance play a crucial role in managing the financial burden of cancer treatment. While insurance does not guarantee protection from financial difficulties, it can provide peace of mind and help alleviate some of the stress associated with cancer treatment.

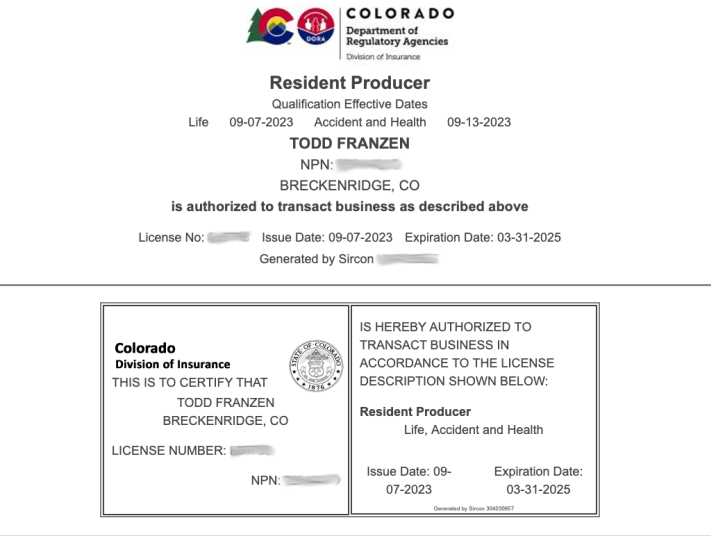

This topic has profoundly impacted me throughout my treatment and recovery. It has inspired me to deeply understand the vast insurance marketplace and acquire a producer license. A goal of mine is to assist fellow survivors in navigating this complex landscape.

Coping Strategies for Cancer-Related Financial Stress

Dealing with cancer is tough enough, but adding financial stress can be overwhelming. As a two-time lymphoma cancer survivor, I know firsthand the challenges of cancer-related financial stress. However, there are ways to cope with this stress and make it more manageable.

Here are some coping strategies that can help:

1. Create a Budget

One of the first things you should do is create a budget. A budget can help you track your expenses and prevent overspending. It can also help you identify areas where you can reduce costs.

2. Ask for Help

Don’t be afraid to ask for help. There are many organizations and resources available to cancer patients and survivors. These organizations can provide financial assistance, emotional support, and other resources to help you cope with cancer-related financial stress.

3. Communicate with Your Healthcare Team

It’s essential to communicate with your healthcare team about your financial concerns. They may be able to offer suggestions or refer you to resources that can help. They may also be able to help you find ways to reduce your medical expenses.

4. Look for Ways to Reduce Expenses

There are many ways to reduce expenses. For example, you can shop for the prices of the best medication or medical supplies. You can also look for ways to reduce your utility bills or other household expenses.

5. Practice Self-Care

Finally, it’s important to practice self-care. Cancer-related financial stress can take a toll on your mental and emotional health. Take care of yourself by getting enough rest, eating a healthy diet, and engaging in activities you enjoy.

Cancer-related financial stress is a genuine concern for many cancer patients and survivors. However, there are ways to cope with this stress and make it more manageable. By following these coping strategies, we can reduce our stress levels and focus on our health and well-being.

The Role of Non-Profit Organizations in Cancer Finance

Non-profit organizations play a crucial role in providing financial assistance to cancer patients. These organizations are dedicated to raising funds for cancer research, education, and patient support. They offer a range of services and resources to help ease the financial burden of cancer treatment. Here are some ways non-profit organizations support cancer patients:

- Financial Assistance: Many non-profit organizations offer financial assistance programs to help patients cover the cost of treatment, medication, and other expenses. The Cancer Financial Assistance Coalition (CFAC) is a group of national organizations that provide financial help to patients. CFAC provides a searchable database of financial resources. Cancer Care offers limited financial assistance for co-pays, transportation, home care, and child care.

- Patient Navigation: Non-profit organizations provide patient navigation services to help patients navigate the healthcare system, find resources, and access support services. Patient navigators work with patients to identify their needs and connect them with the appropriate resources. The American Cancer Society offers a patient navigation program that provides one-on-one support to cancer patients.

- Education and Support: Non-profit organizations provide education and support services to help patients and their families cope with cancer’s emotional and practical aspects. They offer support groups, counseling services, and educational resources to help patients and their families understand the disease and its treatment. The Cancer Support Community provides free support and education to cancer patients and their families.

- Advocacy: Non-profit organizations advocate for cancer patients locally, state, and nationally. They work to improve access to care, promote cancer research, and increase funding for cancer programs. The American Cancer Society Cancer Action Network (ACS CAN) is a non-profit advocacy organization that ensures cancer patients have access to quality care and treatment.

In summary, non-profit organizations play a vital role in supporting cancer patients. They provide financial assistance, patient navigation, education and support, and advocacy services to help patients and their families cope with the challenges of cancer.

Government Policies and Cancer Finances

Regarding cancer finances, government policies play a crucial role in supporting and assisting cancer patients. Governments worldwide recognize the financial burden that cancer can place on patients and their families and are taking steps to provide financial assistance.

In the United States, for example, the Affordable Care Act (ACA) has helped to make healthcare more affordable for cancer patients. The ACA has eliminated lifetime caps on insurance coverage, prevented insurers from denying coverage to people with pre-existing conditions, and required insurers to cover essential health benefits, including cancer treatment.

In addition to the ACA, other government programs can provide financial assistance to cancer patients. For example, the Social Security Disability Insurance (SSDI) program provides financial aid to people who cannot work due to a disability, including cancer. The Supplemental Nutrition Assistance Program (SNAP) provides food assistance to low-income individuals and families, including cancer patients who may struggle to afford nutritious food.

While government policies can provide crucial financial assistance to cancer patients, it is essential to note that not all patients may qualify for these programs. Additionally, some programs may have strict eligibility requirements or provide limited financial assistance.

Overall, government policies can play a crucial role in helping to alleviate the financial burden of cancer. However, cancer patients and their families must explore all available financial assistance options and work with healthcare providers and financial counselors to develop a comprehensive financial plan.

Final Thoughts

As two-time lymphoma cancer survivors, we know firsthand the devastating impact that cancer can have on our finances. Even with insurance, medical bills can quickly pile up and cause significant financial strain. Unfortunately, many of us lack the financial education to understand the implications of such a shock fully.

We must prioritize financial education and proactively protect ourselves from financial hardship. This may include seeking guidance from financial professionals, creating a budget, and regularly assessing our insurance coverage.

While insurance can provide some protection, reviewing policies and carefully understanding the limitations and exclusions is essential. We must also proactively advocate for ourselves and our loved ones to ensure we receive the best care without unnecessary financial burdens.

This intersection of cancer and finances is complex and insanely overwhelming. However, prioritizing financial education and taking proactive steps to protect ourselves can alleviate some of the stress and uncertainty of a cancer diagnosis. That’s what I’m doing! -T

Frequently Asked Questions

What financial resources are available to cancer patients?

Cancer patients can access various financial resources to help them manage the cost of treatment. Some of these resources include non-profit organizations that offer financial assistance, government programs, and patient assistance programs offered by pharmaceutical companies. Patients can also seek help from social workers, financial counselors, or patient navigators who can guide them through accessing financial resources.

What is the average cost of cancer treatment with insurance?

The cost of cancer treatment with insurance varies depending on the type of cancer, stage, and treatment plan. According to the American Cancer Society, the average cost of cancer treatment ranges from $10,000 to $30,000 per month. However, with insurance coverage, patients may only be required to pay a portion of the cost through co-pays, deductibles, and coinsurance.

What is the financial burden of cancer treatment without insurance?

The financial burden of cancer treatment without insurance can be significant. Patients may have to pay the total cost of treatment, which can be tens of thousands of dollars per month. This can lead to financial distress, bankruptcy, and debt. However, resources are available to help uninsured patients manage the cost of cancer treatment.

How can cancer patients manage their finances during treatment?

Cancer patients can manage their finances during treatment by creating a budget, negotiating medical bills, seeking financial assistance, and exploring alternative treatment options. Patients can also seek help from financial counselors, social workers, or patient navigators who can guide managing finances during treatment.

What is the impact of cancer on a patient’s financial stability?

Cancer can have a significant impact on a patient’s financial stability. Patients may have to take time off work, incur medical bills, and experience a loss of income. This can lead to financial distress, bankruptcy, and debt. However, resources are available to help patients manage the economic impact of cancer.

Are there any government programs that provide financial assistance to cancer patients?

Yes, there are government programs that provide financial assistance to cancer patients. These programs include Medicaid, Medicare, and Social Security Disability Insurance. Patients can also seek help from non-profit organizations that offer financial assistance or patient assistance programs offered by pharmaceutical companies.